We are here for you

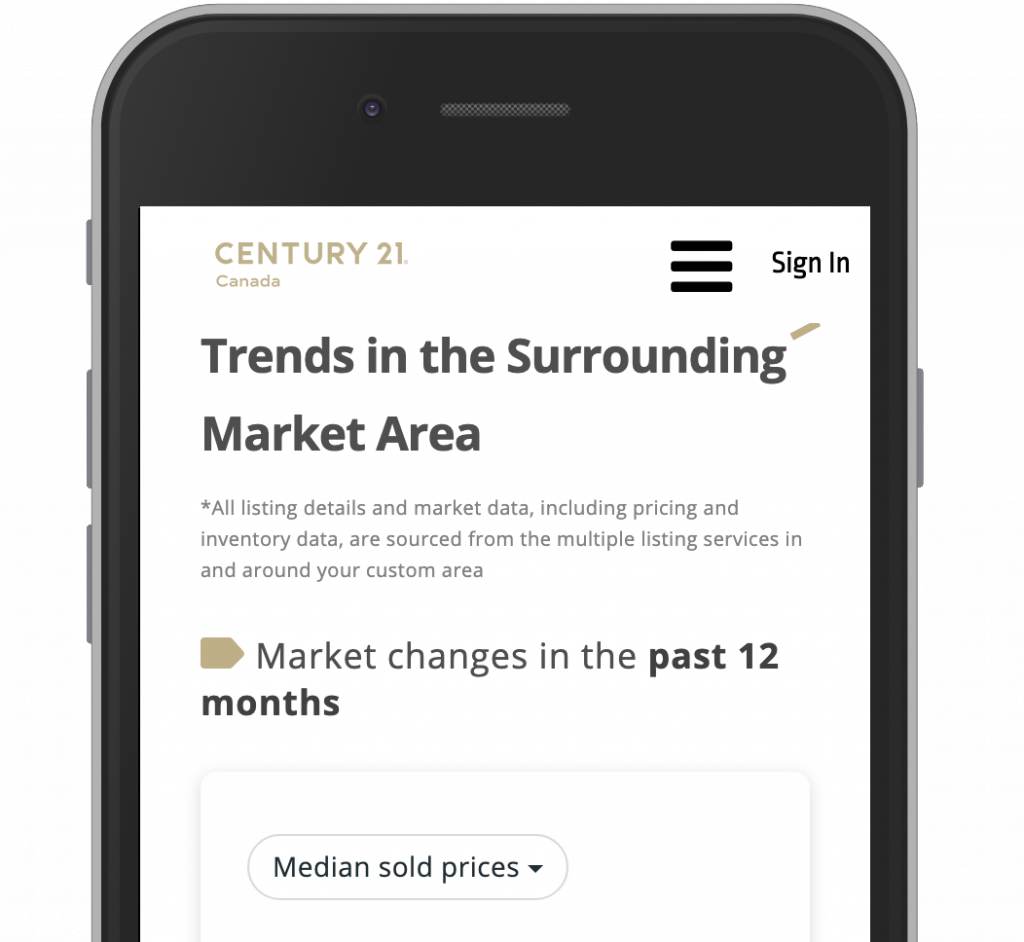

Buying a home is one of the largest financial transactions you will make in your life, so there are many important questions to consider when purchasing a home. A CENTURY 21® REALTOR® goes beyond the transaction and will be there with you every step of the way. Trust the experience of a CENTURY 21 Realtor to help you find your dream home.

We are here for you

Buying a home is one of the largest financial transactions you will make in your life, so there are many important questions to consider when purchasing a home. A CENTURY 21® REALTOR® goes beyond the transaction and will be there with you every step of the way. Trust the experience of a CENTURY 21 Realtor to help you find your dream home.

Supporting you every step of the way

If you're buying, I can enhance your search process by helping you uncover what you may not have considered. Whether it is schools, lifestyle, or the investment value of the property. Using our property search tools, you will be able to find the home that best meets your needs. Finally, with the knowledge of the market, real estate expertise and negotiating skills, I will help you get the best possible deal and handle all the critical details.

Take the next step in your journey

I look forward to working with you and helping you reach your home ownership goals. Reach out to get in touch and start the process today. I offer:

HOME BUYER'S GLOSSARY

AMORTIZATION PERIOD

The number of years it takes to repay the entire amount of the financing based on a set of fixed payments.

APPRASIAL

The process of determining the market value of a property.

CLOSED MortgageS

A mortgage that can not be prepaid or negotiated for a set period of time without penalties.

Closing date

The date on which the new owner takes possession of the property and the sale becomes final.

Collateral

An asset, such as term deposit, Canada Savings Bond, or automobile, that you offer as security for a loan.

Deposit

A sum of money deposited in trust by the purchaser on making an offer to purchase. When the offer is accepted by the vendor (Seller), the deposit is held in trust by the listing real estate broker, lawyer, or notary, until the closing date of sale, at which point it is given to the vendor.

Equity

The difference between the market value of the property and any outstanding mortgages registered against the property. This difference belongs to the owner of that property.

MORTGAGE

A mortgage is a loan that uses a piece of real estate as a security. Once the loan is paid-off, the lender provides a discharge for that mortgage.

Term

The period of time the financing agreement covers. The terms available are; 6 month, 1,2,3,4,5,6,7,10 year terms, and the interest rate will be fixed for whatever term one chooses.